About DRIFT Protocol: Review and All You Need to Know

Drift Protocol, also known as Drift (DRIFT), is a decentralized exchange (DEX) platform built on the Solana blockchain. It has positioned itself as an advanced DeFi protocol, offering users high-speed, low-cost trading across a range of financial instruments, including perpetual futures, spot trading, swaps, and more. With its launch in 2021, Drift has gained rapid traction, amassing a community of over 90,000 users and locking in a total value of approximately $350 million. In this in-depth review, we’ll cover everything about the Drift Protocol, from its core features to its governance model, risks, and practical aspects like buying and storing DRIFT tokens.

What is Drift Protocol?

Drift Protocol powers its operations using the DRIFT token, which serves as the platform’s governance token, allowing users to vote on proposed changes and actively engage with its community-driven ecosystem. This governance model enables Drift to stay agile and aligned with its users’ preferences, ensuring it can evolve and grow over time.

Drift stands out in the DeFi space for its diverse suite of financial tools, which offer various trading options and earning opportunities. Some of its core functionalities include:

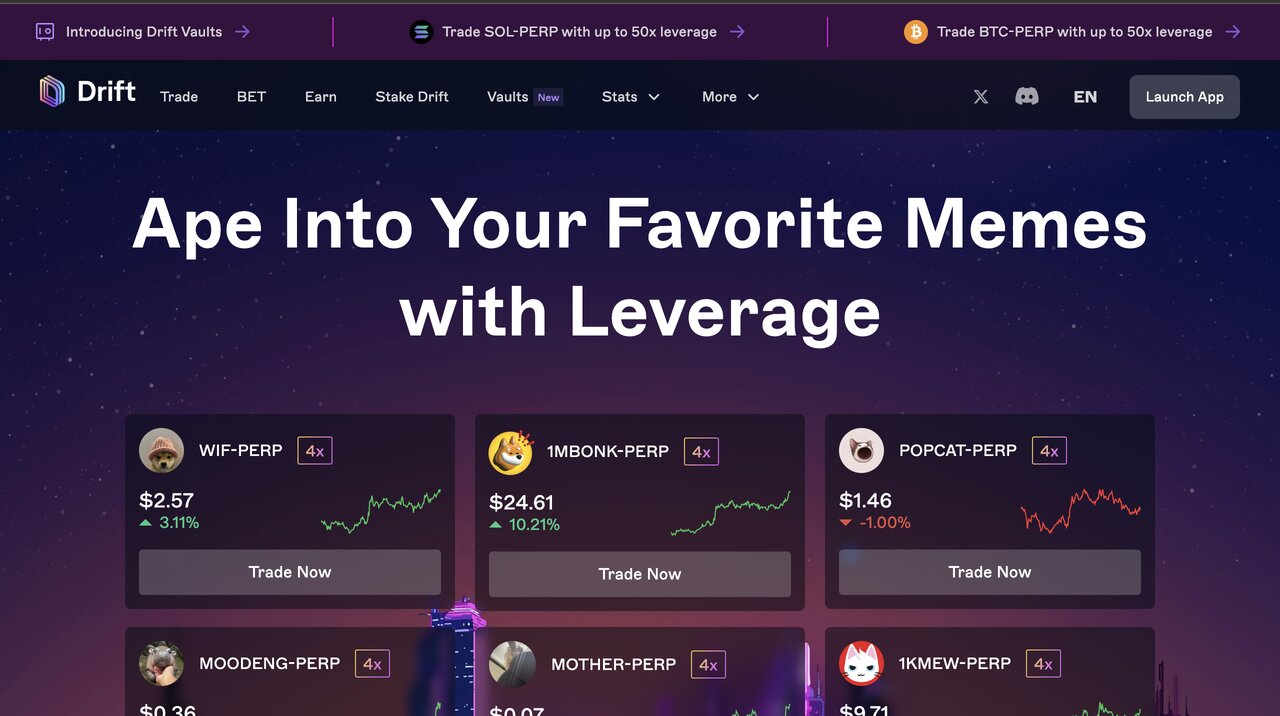

- Perpetual Futures Trading: A popular feature on Drift, perpetual futures allow users to leverage assets without expiration.

- Spot Trading: Users can engage in direct buying and selling of assets.

- Swaps: Drift’s swap feature lets users trade one cryptocurrency for another directly.

- Lending and Borrowing: Users can lend assets to earn interest or borrow to gain leverage for trading.

- Staking and Liquidity Pools: These mechanisms provide users with additional earning opportunities through staking rewards and liquidity provision.

Overall, Drift is a versatile and robust DeFi platform, catering to both novice and experienced traders.

How Drift Protocol Works

To understand Drift’s functionality, it’s helpful to look at the fundamental technologies and systems underlying its operations.

Solana Blockchain

Drift operates on Solana, a blockchain known for its high throughput and low transaction costs. Solana’s architecture allows Drift to process transactions in seconds, enabling traders to operate efficiently and affordably. Here are some benefits of Solana that directly impact Drift users:

- Scalability: Solana is designed to handle thousands of transactions per second (TPS), which supports Drift’s goal of providing a smooth and responsive trading experience.

- Low Fees: Transactions on Solana cost a fraction of those on Ethereum and other blockchains, making it ideal for users who want to trade without paying exorbitant gas fees.

- Ecosystem Synergy: Solana’s ecosystem includes various DeFi projects, DEXs, and NFT platforms, which open up further possibilities for Drift to integrate and expand its offerings.

Drift Protocol Layer

Drift leverages Solana’s infrastructure but has also built its protocol layer, optimizing for speed and usability in DeFi trading. Drift’s protocol includes automated market-making (AMM) algorithms, which ensure liquidity and fair pricing across its different trading pairs. The protocol is further bolstered by smart contract-based mechanisms that maintain security and automation throughout the platform.

Decentralized Governance

Drift is unique among DEX platforms for its multi-branch decentralized autonomous organization (DAO), allowing DRIFT token holders to make decisions on upgrades, fees, and other protocol features. This governance structure decentralizes control over Drift, creating a user-first approach to development. Through voting rights and proposal mechanisms, users directly influence Drift’s future.

Key Features of Drift Protocol

Trading Options

Drift Protocol provides several trading formats, each catering to different strategies and levels of experience. Here’s a breakdown of its core trading options:

Perpetual Futures Contracts

One of Drift’s standout features is perpetual futures trading. Unlike traditional futures contracts, which have a set expiration date, perpetual futures allow traders to hold positions indefinitely. This trading style appeals to users who want leveraged exposure without the need to roll over contracts. Here’s what makes Perpetual on Drift unique:

- Leverage Flexibility: Users can leverage their trades, amplifying potential gains but also increasing risk. Drift’s Perpetual cater to more advanced traders who use these contracts to maximize returns.

- Funding Rate Mechanism: Drift uses funding rates to keep the perpetual price aligned with the spot price. This helps ensure that the perpetual contract remains tethered to the real-time value of the underlying asset, reducing price discrepancies and volatility.

Spot Trading

For users looking for simplicity, Drift’s spot trading allows for the straightforward purchase and sale of assets. Spot trading is popular among beginners and those who prefer to hold assets long-term. By trading directly on the spot market, users avoid the complexity of derivatives while still benefiting from Solana’s low transaction fees.

Swap Functionality

The swap function on Drift is designed for users who want to quickly exchange one asset for another. Swaps are highly convenient, allowing users to change their portfolio composition with ease and without needing to hold the underlying asset. Here’s how Drift’s swap functionality enhances the trading experience:

- Low Slippage: Drift’s protocol ensures low slippage on swap transactions, so users experience minimal price fluctuations between the transaction start and completion.

- Instant Settlement: Swaps on Drift are settled in real time, meaning users have immediate access to their new assets.

Earning Opportunities

Drift goes beyond traditional trading by offering multiple ways to earn passive income, adding to its appeal for investors looking to grow their crypto portfolios.

Lending and Borrowing

Lending and borrowing on Drift allow users to earn interest on their assets or access additional capital for trading. This function supports liquidity on the platform and offers the following benefits:

- Interest Earnings: Lenders on Drift can earn interest by providing assets to borrowers, creating a low-risk passive income stream.

- Leverage for Trading: Borrowers can use the funds they borrow to amplify their trading positions, leveraging assets for potentially higher returns.

Insurance Fund Staking

Insurance fund staking allows users to earn rewards by staking assets in Drift’s insurance pool. This pool is designed to safeguard the platform against unexpected market shocks, adding stability and protecting against large liquidations. Key points of this feature include:

- Reward Generation: Stakers receive rewards from the insurance fund, incentivizing users to contribute to platform stability.

- Security for Traders: In the event of extreme market conditions, the insurance fund can cover losses, preventing negative spillovers and preserving capital.

Market Maker Rewards

Drift incentivizes liquidity provision through market maker rewards, which compensate users who actively create order book liquidity. By providing liquidity, market makers help ensure smooth trading, reduce slippage, and improve the overall experience. This feature makes Drift attractive to traders who want to make passive income by supplying liquidity.

The DRIFT Token and Governance

Governance Structure

The DRIFT token powers governance on the protocol through a multi-branch DAO model. Here’s how it works:

- Token Holder Rights: DRIFT token holders can vote on various protocol proposals, such as fee adjustments, upgrades, and feature development. This model ensures that users have a say in Drift’s direction, making it a truly community-driven platform.

- Proposal System: Any DRIFT holder can submit a proposal to the DAO. Proposals that pass an initial screening process are presented for community voting.

- Decentralization: By distributing governance rights among token holders, Drift avoids centralized control and ensures it remains aligned with the needs and preferences of its user base.

Tokenomics and Value

The DRIFT token has a capped supply of 1 billion tokens, with about 250 million tokens currently in circulation. The DRIFT token’s value lies in its utility as both a governance asset and a trading fee discount mechanism on the platform. As demand for governance participation and trading increases, so does the potential value of DRIFT tokens.

Risks and Considerations

While Drift offers numerous benefits, users should be aware of its associated risks:

- Market Volatility: Perpetual futures, in particular, carry high risk due to leverage and price swings. Users must manage positions carefully to avoid liquidation during volatile market periods.

- Funding Rate Implications: As perpetual prices deviate from spot prices, funding rates can become costly, especially during high volatility. Understanding these rates is essential for profitable trading.

- Security Risks: Although Drift has a strong security infrastructure, DeFi platforms can be vulnerable to smart contract risks. It’s crucial for users to remain vigilant, use secure wallets, and only access Drift through verified channels.

How to Store Drift Tokens (DRIFT)

Storing DRIFT securely ensures users can participate in governance and manage assets safely. Here’s a step-by-step guide on storing DRIFT tokens:

- Setting Up a Compatible Wallet: The Phantom wallet is recommended for Solana-based tokens like DRIFT. Install the Phantom browser extension or mobile app and set up a new wallet.

- Storing DRIFT: After setting up Phantom, users can send DRIFT tokens to their wallet address. Phantom’s interface makes it easy to view and manage balances, stake tokens, and more.

For additional security, users may opt to store DRIFT in a hardware wallet compatible with Solana, such as Ledger.

How to Buy Drift Tokens (DRIFT)

Users have several options for buying DRIFT tokens. Each platform varies slightly in terms of process and features:

Step-by-Step Guide for Buying DRIFT on KuCoin, Bybit, MEXC

KuCoin, Bybit, and MEXC are some of the most popular exchanges that listed DRIFT token, and offers a user-friendly interface for both new and experienced traders. Here’s a step-by-step guide:

- Create an Account: If you don’t already have an account on these exchanges, go to KuCoin, Bybit and MEXC and register by entering your email address and creating a secure password. Complete any necessary identity verification for increased withdrawal limits.

- Fund Your Account: Once registered, navigate to the “Assets” section and click “Deposit.” Select a cryptocurrency that is tradable against DRIFT (such as USDT or SOL), and deposit funds to your KuCoin wallet. Follow the instructions provided by KuCoin to complete the deposit process.

- Navigate to the DRIFT Market: Once your deposit is confirmed, go to the “Markets” section and search for “DRIFT” or “DRIFT/USDT.” Click on the trading pair to open the trading interface.

- Place a Buy Order: In the trading interface, you’ll see an option to place a “Limit” or “Market” order. For instant buying, select “Market,” enter the amount of USDT you wish to spend, and confirm the transaction. Your order will be executed immediately at the best available price.

- Withdraw DRIFT to Your Wallet: After purchasing, it’s recommended to transfer your DRIFT tokens to a secure wallet, such as the Phantom wallet, for safekeeping. Go to the “Assets” section, select DRIFT, and click “Withdraw.” Enter your wallet address and confirm the transfer.

Alternative Ways to Buy DRIFT Tokens

Aside from KuCoin, there are other platforms where you can buy DRIFT tokens. Here are some alternative options:

- Decentralized Exchanges (DEXs): As a DeFi token, DRIFT is often available on decentralized exchanges built on Solana, such as Serum or Raydium. To use these platforms, connect a wallet like Phantom, locate DRIFT, and trade it directly without an intermediary.

- Direct Purchase Using Fiat (if supported): Some platforms allow direct purchase of DRIFT with fiat (USD, EUR, etc.) if they have an integrated fiat gateway. Always check for this option, as it may simplify the purchasing process for users who don’t hold other cryptocurrencies.

- Peer-to-Peer (P2P) Trading: Certain platforms support P2P trades where users can buy DRIFT from other individuals. Always use a secure, escrow-based P2P platform to minimize counterparty risks.

Each method has its pros and cons. For example, DEXs provide enhanced privacy and decentralization but may have higher fees or require more setup steps for users unfamiliar with DeFi platforms.

Drift Protocol in Comparison to Competitors

When evaluating Drift, it’s helpful to compare it to other leading DeFi platforms to understand where it excels and where it may have limitations. Let’s look at a few comparisons:

Drift vs. Uniswap

- Blockchain: Drift is based on Solana, while Uniswap operates on Ethereum. Solana’s lower fees and faster transactions give Drift an edge in speed and cost-effectiveness, although Ethereum’s larger ecosystem provides Uniswap with more liquidity and trading pairs.

- Trading Options: Uniswap primarily focuses on spot trading and lacks perpetual futures, which are a core feature of Drift. This makes Drift more appealing to users interested in leveraged trading.

- Governance: Both platforms utilize DAO models, but Drift’s model is more layered, allowing for multi-branch voting systems, whereas Uniswap’s governance is more centralized.

Drift vs. dYdX

- Perpetual Futures: Both Drift and dYdX offer perpetual futures trading. However, dYdX operates on a Layer 2 solution built on Ethereum, making it slightly slower and more expensive in comparison to Solana-based Drift.

- Liquidity Provision: Drift’s AMM model for liquidity rewards is distinct from dYdX’s order book system, providing a different approach to liquidity and market making.

- User Interface: dYdX has a more established user interface that caters to advanced traders, while Drift’s interface is more simplified, making it more accessible to users newer to perpetual futures.

These comparisons show that Drift’s unique value propositions lie in its Solana-based speed and its multi-feature trading platform, making it an attractive choice for users who prioritize fast transactions and a variety of trading options.

Use Cases and Practical Applications of Drift

Drift Protocol supports multiple use cases across different types of DeFi participants. Here’s a look at the types of users who can benefit from Drift and how they might use the platform:

For Active Traders

Active traders looking for an exchange with low transaction fees and a variety of trading options can use Drift to execute frequent trades with minimal costs. Drift’s perpetual futures feature is particularly appealing to traders who want to capitalize on leverage and advanced trading strategies.

For Long-Term Investors

Investors who prefer to buy and hold can use Drift’s spot trading function to purchase assets with low fees and store them in a compatible wallet. Additionally, they may benefit from staking their DRIFT tokens, as this can provide governance participation and potential staking rewards.

For Passive Income Seekers

Passive income seekers can engage with Drift’s liquidity pools or stake their tokens to earn rewards. Lending and borrowing options also provide passive income through interest earnings, making Drift a versatile platform for users interested in yield farming and earning interest on their holdings.

For Institutional Traders

Institutions looking for liquidity and low slippage on large trades may find Drift’s liquidity rewards and low fees beneficial. The platform’s design can support institutional trading by offering secure, high-speed transactions on Solana’s blockchain.

Future Prospects and Roadmap

Drift Protocol’s team has laid out a roadmap that includes several promising developments. Here are some potential future upgrades:

1. Cross-Chain Integration: Drift plans to integrate cross-chain capabilities, allowing users to trade assets across multiple blockchains. This would expand its liquidity pool and attract a more diverse user base.

2. Expansion of Supported Assets: The protocol is considering adding more trading pairs and expanding its range of financial instruments. This could attract users interested in trading lesser-known assets.

3. Mobile App Development: To enhance accessibility, Drift’s team has indicated plans to develop a mobile application, enabling users to trade on the go.

4. Improved Security and Auditing: Drift has ongoing plans to conduct regular security audits and improve the safety features of its smart contracts. This includes implementing multi-signature wallets for large transactions and expanding its insurance fund.

The future roadmap highlights Drift’s commitment to growth, security, and a user-focused approach. As Drift evolves, these updates could attract more users and enhance its market position.

Conclusion: Is Drift Protocol Right for You?

Drift Protocol offers a comprehensive DeFi platform with a strong suite of trading options, low transaction fees, and a community-driven governance model. For active traders, Drift’s perpetual futures, spot trading, and swap functionality offer flexibility and potential for high returns. Passive income seekers also benefit from liquidity rewards, staking, and lending opportunities.

However, users should approach Drift with a clear understanding of its risks, especially in leveraged trading. As with any DeFi protocol, security remains a priority, and users must safeguard their assets by using reputable wallets and maintaining good security practices.

With its ambitious roadmap, Drift has positioned itself as a promising platform for traders and investors alike. For users looking for a cost-effective, high-speed, and flexible DeFi protocol, Drift may offer the perfect combination of tools and community-driven governance.

Disclaimer

This article is for informational purposes only and should not be considered financial or investment advice. Drift Protocol, like all cryptocurrency platforms and investments, carries inherent risks, including but not limited to market volatility, regulatory changes, and technology vulnerabilities. The cryptocurrency market is highly speculative, and users should conduct their research and consider their financial situation and risk tolerance before engaging in trading or investing.

Additionally, DeFi platforms are subject to unique risks, including smart contract vulnerabilities and liquidity risks. You are responsible for any financial decisions you make and should consult with a financial advisor if you have questions regarding investments or risk management.

The author and publisher of this article are not liable for any losses or damages resulting from the use of the information provided. Please exercise caution and ensure that you use only official links and resources when engaging with Drift Protocol or any related DeFi platform.

The Crypto Watchlist of the Week 🔎

Subscribe to receive expert-curated projects with real potential—plus trends, risks, and insights that matter. Get handpicked crypto projects, deep analysis & market updates delivered to you.