Crypto Scams 101: Common Cryptocurrency Scams and How to Avoid Them

Cryptocurrency has revolutionized the financial landscape, offering unprecedented opportunities for investment and innovation. However, with these opportunities come significant risks, particularly in the form of scams. As the crypto market continues to grow, so does the sophistication of scams targeting unsuspecting investors. This article will explore the most common crypto scams, provide insights into how they operate, and offer practical tips on how to avoid falling victim to them.

Understanding Cryptocurrency Scams

Cryptocurrency scams can take many forms, but they generally exploit the lack of regulation and the anonymity that digital currencies provide. Scammers often prey on individuals’ lack of knowledge about the crypto space, using various tactics to deceive and defraud them.

Types of Crypto Scams

1. Phishing Attacks: The Classic Trap

Phishing is one of the oldest tricks in the book when it comes to online scams, and it’s made its way into the crypto world. Phishing attacks involve fraudsters creating fake websites or sending emails that mimic legitimate cryptocurrency platforms. The goal is to trick you into revealing sensitive information, such as your wallet’s private keys or exchange login credentials. Once they have access to your account, they can steal your funds in seconds.

How Phishing Scams Work

Imagine receiving an email from what seems to be a trusted cryptocurrency exchange like Binance or Coinbase. The email may inform you that there’s a security issue with your account, urging you to log in immediately to resolve the problem. The email contains a link that directs you to a website that looks identical to the legitimate one but is, in fact, a fake. Once you enter your login details, scammers use them to access your real account and drain your crypto holdings.

Phishing scams are also common through direct messages on social media platforms or messaging apps, with scammers posing as customer support agents, influencers, or even friends.

How to Avoid Phishing Attacks

1. Verify the URL: Always ensure you’re visiting the legitimate website of a crypto exchange or wallet service. Double-check the URL for accuracy, as scammers often create domains that are slightly misspelt (e.g., “binace.com” instead of “binance.com”).

2. Avoid Clicking on Unverified Links: If you receive an unsolicited email or message asking you to log in to your crypto account, do not click the link. Instead, go directly to the official website by typing the URL into your browser manually.

3. Use Two-Factor Authentication (2FA): Enable 2FA on all your crypto accounts to add an extra layer of security. Even if a scammer gets your login details, they won’t be able to access your account without the second authentication factor.

2. Fake Giveaways: Too Good to Be True

Fake crypto giveaways are one of the most common scams on social media platforms. Scammers promise to double or triple the amount of cryptocurrency you send them, typically under the guise of a giveaway. You might see these offers in Twitter replies, Telegram groups, or even on fraudulent YouTube channels where the scammer pretends to be a famous person or a well-known crypto project.

How Fake Giveaways Work

Let’s say you follow a popular crypto influencer on Twitter. One day, you notice a tweet claiming that the influencer is doing a special giveaway for their followers, promising to double any amount of Bitcoin sent to their wallet. To participate, you’re instructed to send a small amount of Bitcoin to a given address, with the promise of receiving double that amount in return.

Of course, once you send the crypto, you never hear from the “giveaway” again. These scams prey on people’s excitement about getting free money and their trust in well-known figures in the crypto community.

How to Avoid Fake Giveaways

1. Be Skeptical: If a giveaway seems too good to be true, it probably is. Legitimate companies or influencers will never ask you to send them cryptocurrency first before receiving anything in return.

2. Verify Sources: If you see a giveaway posted by someone you follow, check the authenticity of the account and cross-check with the official social media pages of that person or company. Scammers often create fake accounts that look similar to the real ones.

3. Report Suspicious Activity: Always report any giveaway scams you come across to the relevant platform. This can help prevent others from falling victim.

3. Ponzi Schemes: False Promises of Guaranteed Returns

Ponzi schemes have been around for decades, but the crypto world has given them a fresh avenue. In a crypto Ponzi scheme, scammers promise high returns on investments, often through elaborate marketing campaigns that lure in investors. The scam works by using money from new investors to pay out earlier investors, creating the illusion of a profitable enterprise. Eventually, the scheme collapses when there aren’t enough new investors to pay the earlier ones.

How Ponzi Schemes Work

You might come across a project that promises to multiply your cryptocurrency over a short period of time—say, 30% returns in a month. Initially, the platform may seem legitimate because early investors do receive payments as promised. However, this money comes from the influx of new investors, not from any real profits generated by the platform.

As more people invest, the scheme continues until it inevitably collapses when the scammer can no longer recruit new participants. At this point, the scammer disappears with the remaining funds, leaving most investors with nothing.

How to Avoid Ponzi Schemes

1. Avoid Guaranteed Returns: No legitimate investment, especially in the volatile world of crypto, can guarantee profits. Be cautious of any platform or individual promising high or guaranteed returns with little to no risk.

2. Research the Team: Always research the team behind any investment platform. Be wary of anonymous projects or platforms with vague information about the people running them.

3. Check for Transparency: Legitimate projects will have clear whitepapers, a transparent business model, and an established history. Avoid platforms that rely heavily on recruiting new members rather than generating revenue through actual business operations.

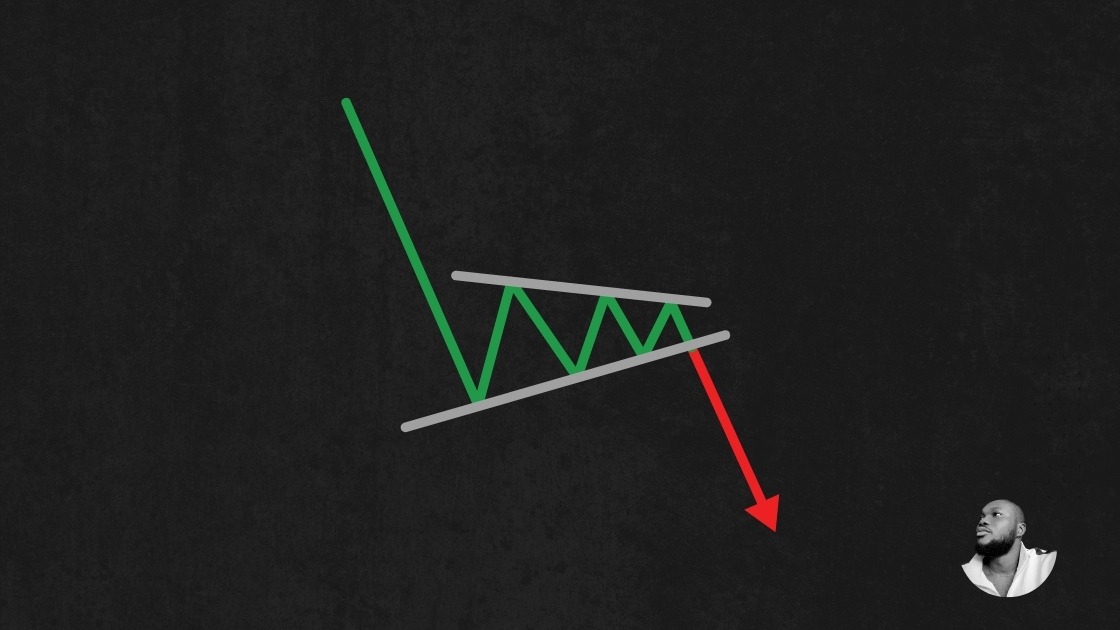

4. Pump-and-Dump Schemes: The Price Manipulation Game

Pump and dump schemes are notorious in the cryptocurrency world, especially with low-cap coins or newly launched tokens. In these scams, a group of people buys large amounts of a specific cryptocurrency to artificially inflate its price (the “pump”). Once the price has risen significantly, they sell off their holdings (the “dump”), causing the price to crash and leaving others with losses.

How Pump and Dump Schemes Work

You may come across a social media post or message from someone urging you to buy a specific cryptocurrency, claiming it’s about to skyrocket in value. This message might be part of a coordinated effort by a group to pump the coin’s price by buying large amounts at the same time. As more people buy into the hype, the price increases.

Once the scammers have driven up the price enough, they sell their holdings for a profit. The price then plummets, leaving those who bought late with worthless coins.

How to Avoid Pump and Dump Schemes

1. Do Your Own Research (DYOR): Before buying into any cryptocurrency, especially one that’s being heavily promoted, research its fundamentals. Look into the project’s purpose, development team, and market potential.

2. Be Wary of Sudden Hype: If a coin suddenly experiences a massive price increase due to social media or messaging apps, it’s often a sign of a pump-and-dump scheme. Avoid FOMO (fear of missing out) and don’t rush into investments based solely on hype.

3. Diversify Your Portfolio: Instead of investing all your funds in a single, highly volatile cryptocurrency, diversify your portfolio with well-established projects that have long-term potential.

5. Fake Crypto Exchanges: Too Risky to Trust

Fake crypto exchanges look and operate just like legitimate ones, but their only purpose is to steal your money. These fraudulent exchanges can be very convincing, with professional-looking websites, customer support, and even trading volumes that appear real. However, once you deposit your cryptocurrency, it becomes impossible to withdraw it.

How Fake Crypto Exchanges Work

Imagine coming across a new crypto exchange with low fees and excellent reviews. After signing up, you deposit some Bitcoin to take advantage of the low fees and start trading. However, when you try to withdraw your funds, you’re met with endless delays, and excuses, or your account is simply frozen.

In other cases, the exchange may allow you to trade normally for a while before it suddenly shuts down, taking all your deposited assets with it.

How to Avoid Fake Crypto Exchanges

1. Stick to Reputable Exchanges: Only use well-known exchanges with a proven track record, such as Binance, Coinbase, or Kraken. If you’re unsure about a platform, check user reviews and feedback on trusted crypto forums like Reddit or Bitcointalk.

2. Look for SSL Certificates: Make sure the exchange website is secure. Look for “https://” at the beginning of the URL and check if the website has an SSL certificate (indicated by a padlock symbol in the browser address bar).

3. Test with Small Amounts: If you’re trying a new exchange, start by depositing a small amount to test its withdrawal process. If you encounter any issues, it’s better to lose a small amount than your entire investment.

6. Impersonation Scams: False Identities and False Promises

Impersonation scams involve fraudsters pretending to be well-known figures in the crypto world—such as influencers, project founders, or even customer support representatives. They approach you with offers of investment opportunities, exclusive deals, or technical support, all to steal your funds.

How Impersonation Scams Work

Let’s say you follow a popular crypto influencer on Instagram. One day, you receive a direct message from an account with the same profile picture and name, offering you a chance to invest in an exclusive crypto project. The message sounds legitimate and the offer looks enticing, especially since it seems to be coming from someone you trust. They ask you to send crypto to a specific wallet address to secure your spot in the investment or to gain access to a special trading group.

However, this account isn’t run by the influencer. It’s an impersonator who has copied their profile and is preying on your trust in that public figure. Once you send your crypto, the scammer disappears, leaving you with no way to recover your funds.

Impersonation scams aren’t limited to influencers. Scammers can also impersonate customer support staff from popular exchanges or wallets, claiming they need access to your private keys or other sensitive information to help you with an issue.

How to Avoid Impersonation Scams

1. Always Verify Identities: Before trusting anyone who reaches out to you about crypto investments, verify their identity. If it’s an influencer or public figure, check if they have a verified account (blue check mark) or cross-reference with their official website or other social media accounts.

2. Be Cautious of Unsolicited Offers: Legitimate influencers or customer support representatives will never DM you first with investment opportunities or ask for your private keys or crypto. If someone reaches out to you with an unsolicited offer, be skeptical.

3. Contact Official Support: If you receive a message from someone claiming to be customer support, always go through the official website or app to verify the communication. Never share your private keys or passwords with anyone, even if they seem legitimate.

Why Crypto Scams Are So Prevalent

The rise of cryptocurrency has brought both innovation and new risks. Several factors contribute to the prevalence of crypto scams, making it easier for fraudsters to exploit unsuspecting individuals:

1. Anonymity: Cryptocurrency transactions are decentralized and often anonymous, making it difficult to trace the culprits behind scams. Once you send crypto to a scammer’s wallet, it’s nearly impossible to recover it.

2. Lack of Regulation: The cryptocurrency market is still relatively unregulated compared to traditional financial systems. While this allows for more freedom in how crypto can be used, it also creates opportunities for scammers to operate without oversight.

3. Newcomers to the Market: Many people entering the crypto space are new to the technology and lack the knowledge to identify scams. Scammers take advantage of this by targeting individuals who are unfamiliar with how to protect themselves.

4. Global Nature of Crypto: Since cryptocurrencies are accessible from anywhere in the world, scammers can target victims across borders, making it more difficult for authorities to shut down fraudulent operations.

Additional Tips for Staying Safe in the Crypto Space

In addition to avoiding the specific scams mentioned above, some general best practices can help you stay safe when dealing with cryptocurrencies:

1. Use a Hardware Wallet: For long-term storage of your crypto assets, consider using a hardware wallet. These devices store your private keys offline, making them much less vulnerable to hacking and online scams.

2. Regularly Update Your Software: Ensure that your wallet and any cryptocurrency-related apps you use are always up to date. Software updates often include security patches that protect against known vulnerabilities.

3. Don’t Share Your Private Keys: This cannot be stressed enough—never, under any circumstances, share your private keys or seed phrases with anyone. Your private keys are the only way to access your crypto holdings, and if someone gets hold of them, they can steal your assets.

4. Monitor Your Accounts Regularly: Even if you take all the necessary precautions, it’s important to regularly check your exchange and wallet accounts for any suspicious activity. The sooner you spot unauthorized access, the quicker you can take action to secure your funds.

5. Educate Yourself: The crypto landscape is constantly changing, and new scams and tactics are emerging all the time. Stay informed by reading reliable crypto news sources, joining reputable online communities, and learning from the experiences of others in the space.

The Future of Crypto Scams

As the cryptocurrency market grows, so too will the sophistication of scams. In recent years, we’ve seen the rise of more complex attacks, such as malware that targets crypto wallets, fake Initial Coin Offerings (ICOs), and scams involving decentralized finance (DeFi) platforms.

The development of regulation and legal frameworks around cryptocurrency could help reduce the number of scams, but it’s unlikely that they will disappear completely. Scammers will continue to evolve their tactics, and the best defence is for individuals to stay informed, cautious, and proactive in protecting their digital assets.

What to Do If You Fall Victim to a Crypto Scam

If you realize that you’ve been scammed, it’s important to act quickly, though recovery is often difficult. Here are some steps you can take:

1. Report the Scam: Contact the platform where the scam took place (e.g., a social media site or exchange) and report the fraudulent account or activity. This can help prevent others from being targeted.

2. Contact Your Wallet Provider or Exchange: If you believe your wallet or exchange account has been compromised, immediately reach out to the platform’s support team to try and freeze or recover your funds.

3. File a Report with Authorities: Although recovering your crypto might be difficult, filing a report with local or international authorities can help track down scammers. Agencies like the FBI in the U.S. or Europol in the EU have cybercrime units that handle cryptocurrency-related fraud.

4. Stay Vigilant: Learn from the experience and take steps to better secure your assets moving forward. While it’s unfortunate to fall victim to a scam, it’s an opportunity to improve your security practices and avoid future losses.

Case Studies of Notorious Crypto Scams

BitConnect: The Infamous Ponzi Scheme

BitConnect was one of the most notorious Ponzi schemes in the cryptocurrency world. Launched in 2016, it promised investors high returns through a trading bot that supposedly generated profits from Bitcoin volatility.

Outcome: BitConnect collapsed in early 2018, leading to losses of approximately $1 billion for investors. The founders disappeared, and many investors were left with worthless tokens.

OneCoin: The Global Scam

OneCoin was marketed as a cryptocurrency but was, in reality, a multi-level marketing scheme. It promised high returns and claimed to be a revolutionary digital currency.

Outcome: The scheme raised an estimated $4.4 billion from investors worldwide before its founder, Ruja Ignatova, vanished in 2017. Authorities have since pursued legal action against several individuals involved.

PlusToken: The Chinese Scam

PlusToken was a wallet and investment platform that promised high returns on cryptocurrency investments. It attracted millions of users, primarily in China.

Outcome: In mid-2019, it was revealed to be a Ponzi scheme, leading to losses of around $2 billion. Several individuals were arrested, but the majority of the funds were never recovered.

Statistics on Crypto Scams

– According to a report by the Federal Trade Commission (FTC), consumers lost over $80 million to cryptocurrency scams in 2020 alone, a significant increase from previous years.

– The FBI’s Internet Crime Complaint Center (IC3) reported that cryptocurrency-related scams accounted for over $2.4 billion in losses in 2021.

– A survey by Chainalysis found that 74% of all cryptocurrency scams in 2021 were related to investment fraud.

How to Avoid Crypto Scams

Educate Yourself

The first step in avoiding crypto scams is to educate yourself about the cryptocurrency market. Understanding how cryptocurrencies work, the technology behind them, and the common tactics used by scammers can significantly reduce your risk.

Resources for Education:

- Online courses on platforms like Coursera or Udemy

- Cryptocurrency forums and communities (e.g., Reddit, Bitcointalk, Bitrabo)

- Reputable news sources and blogs focused on cryptocurrency

Verify Before You Invest

Before investing in any cryptocurrency or project, conduct thorough research. Verify the legitimacy of the project, its team, and its technology.

Steps to Verify:

- Check the project’s website and whitepaper for professionalism and transparency.

- Look for team members’ LinkedIn profiles and their previous experience in the industry.

- Search for reviews and feedback from other investors.

Be Wary of Promises of High Returns

If an investment opportunity sounds too good to be true, it probably is. Be cautious of projects that promise guaranteed returns or high profits with little risk.

Red Flags:

- Promises of returns that are significantly higher than the market average.

- Lack of transparency about how returns are generated.

- Pressure to invest quickly to secure a spot or take advantage of a limited-time offer.

Use Reputable Exchanges and Wallets

Always use well-known and reputable cryptocurrency exchanges and wallets. Research their security measures, user reviews, and regulatory compliance.

Recommended Exchanges

- Binance

- Coinbase

- Bybit

Recommended Wallets

- Ledger (hardware wallet)

- Trezor (hardware wallet)

- Exodus (software wallet)

Enable Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security to your accounts. Always enable 2FA on your cryptocurrency exchanges and wallets to protect against unauthorized access.

Be Cautious with Social Media and Online Ads

Scammers often use social media platforms and online advertisements to promote fraudulent schemes. Be skeptical of unsolicited messages or advertisements promising high returns.

Tips:

- Avoid clicking on links from unknown sources.

- Do not share personal information or private keys with anyone online.

- Report suspicious accounts or advertisements to the platform.

Keep Your Software Updated

Ensure that your devices and software are up to date to protect against vulnerabilities. Regular updates can help safeguard your accounts from potential hacks.

Use Cold Storage for Long-Term Holdings

For long-term investments, consider using cold storage solutions, such as hardware wallets, to keep your cryptocurrencies safe from online threats.

I wrote an article on how to secure your crypto investments, take a look.

Conclusion

The cryptocurrency market is filled with potential, but it’s also rife with scams that can target both seasoned investors and newcomers alike. By understanding how these scams work and knowing how to protect yourself, you can navigate the crypto space with greater confidence and security.

Key Takeaways

- Educate Yourself: Knowledge is your best defence against scams.

- Verify Investments: Always conduct thorough research before investing.

- Be Skeptical of High Returns: If it sounds too good to be true, it probably is.

- Use Reputable Platforms: Stick to well-known exchanges and wallets.

- Enable Security Features: Use two-factor authentication and keep software updated.

By following these steps and staying vigilant, you can enjoy the benefits of cryptocurrency without falling victim to the numerous scams that plague the industry. In the end, the key to staying safe in the crypto world is awareness, education, and skepticism.

Disclaimer

The information provided in this article is for educational purposes only and does not constitute financial, legal, or investment advice. Cryptocurrency investments and transactions carry risks, including the potential loss of funds. Always do your own research and consult with a professional advisor before making any financial decisions. The author and publisher are not responsible for any losses or damages resulting from the use of this information.

The Crypto Watchlist of the Week 🔎

Subscribe to receive expert-curated projects with real potential—plus trends, risks, and insights that matter. Get handpicked crypto projects, deep analysis & market updates delivered to you.